AIC and BIC values for the fitted GARCH-type models for stock market... | Download Scientific Diagram

model selection - How to select GARCH lag for forecasting purpose (AIC+likelihood ratio)? - Cross Validated

of the selection of the best-fitting GARCH model following the AIC and... | Download Scientific Diagram

Mathematics | Free Full-Text | Innovation of the Component GARCH Model: Simulation Evidence and Application on the Chinese Stock Market

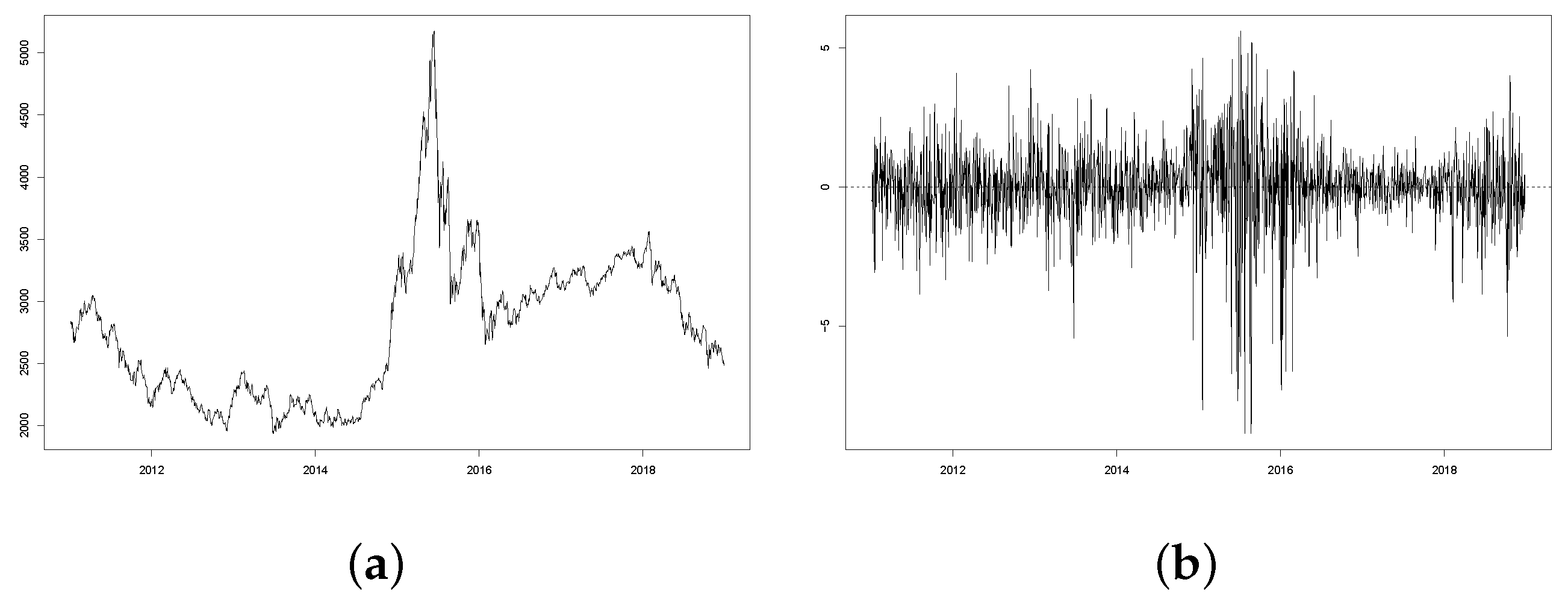

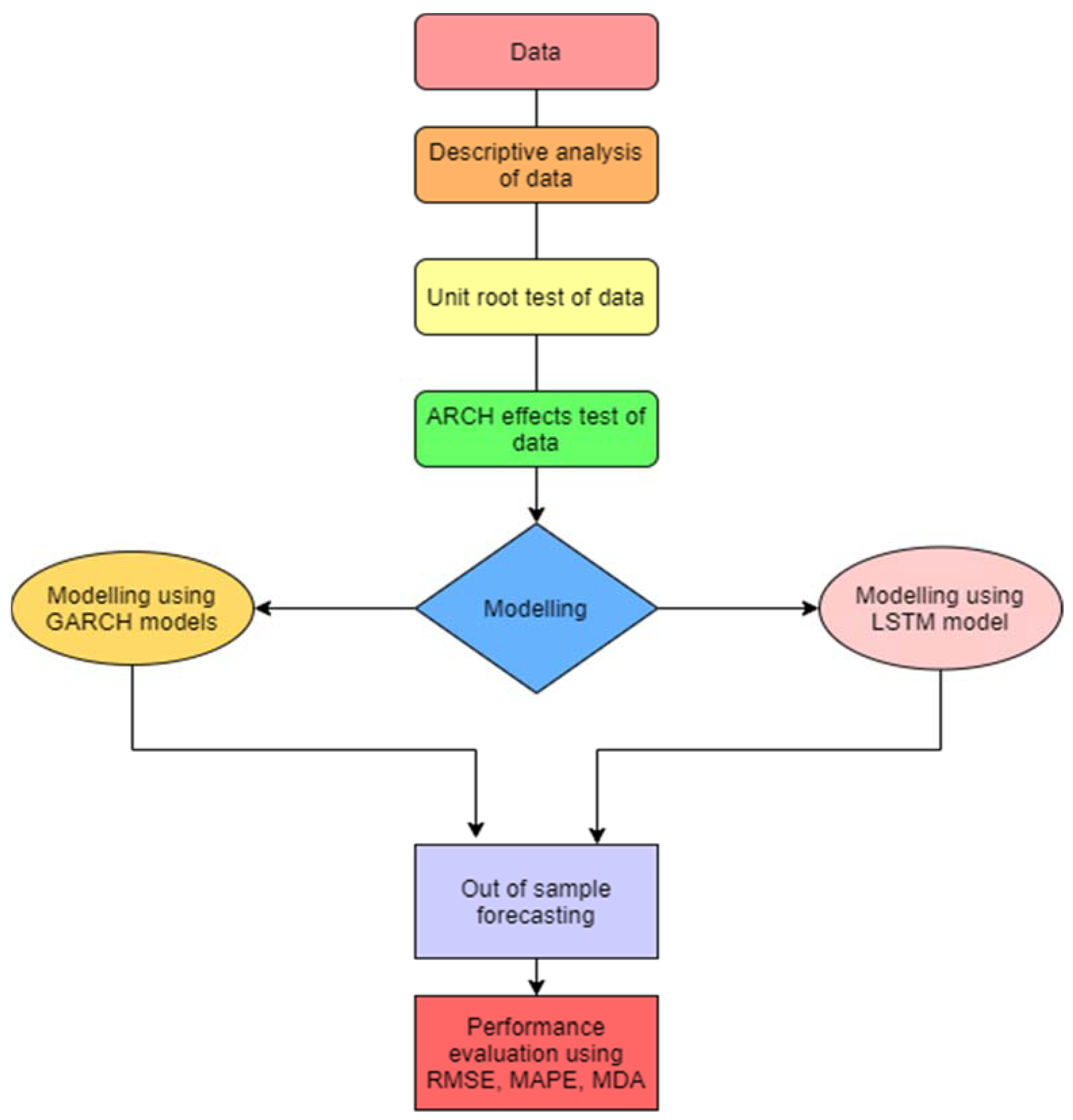

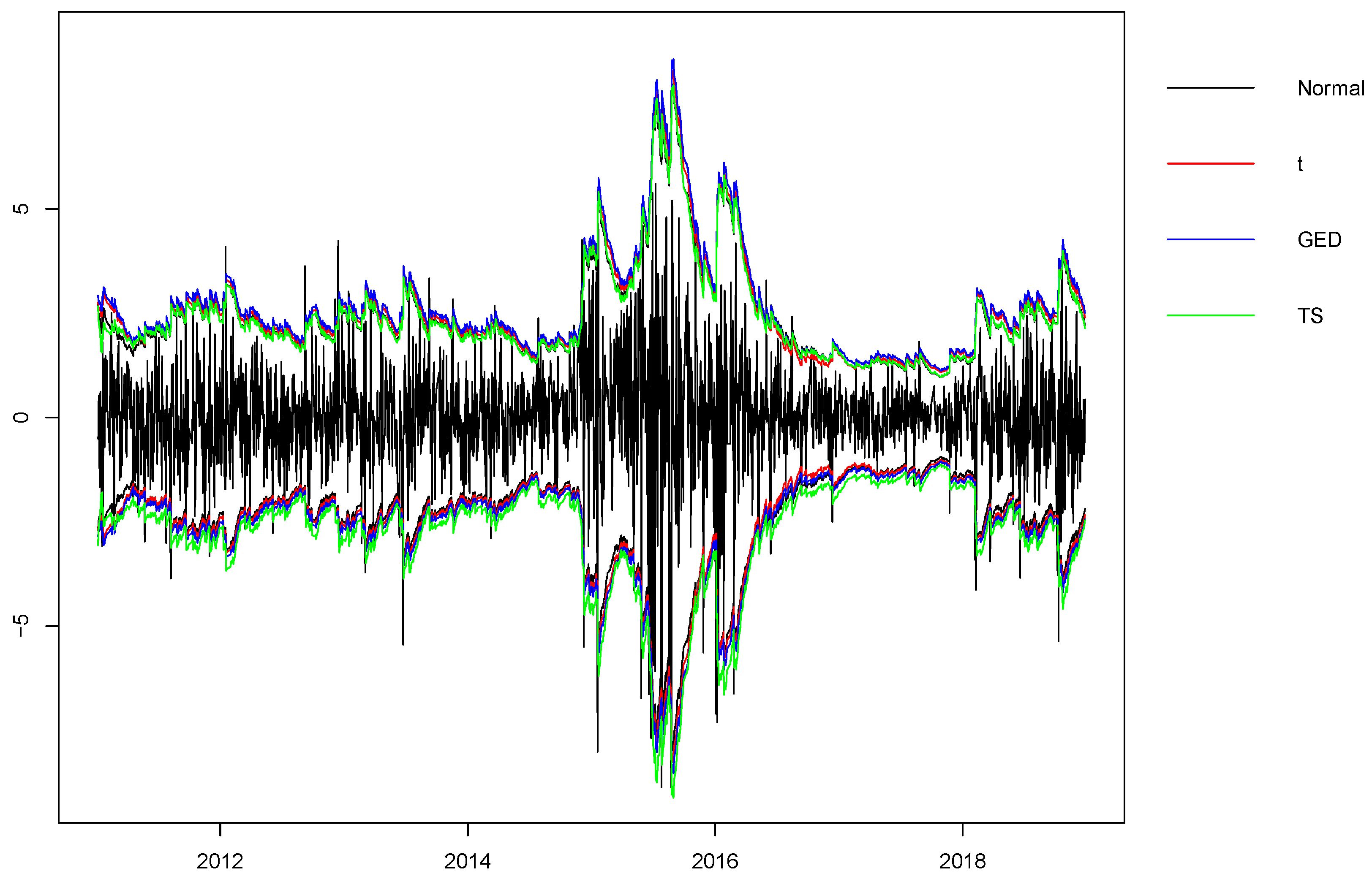

Economies | Free Full-Text | Modeling and Forecasting the Volatility of NIFTY 50 Using GARCH and RNN Models

Energies | Free Full-Text | A Finite Mixture GARCH Approach with EM Algorithm for Energy Forecasting Applications

View of Trend Analysis and GARCH Model for COVID-19 National Weekly Confirmed Cases in Nigeria for Abuja and Lagos State | Quarterly Journal of Econometrics Research

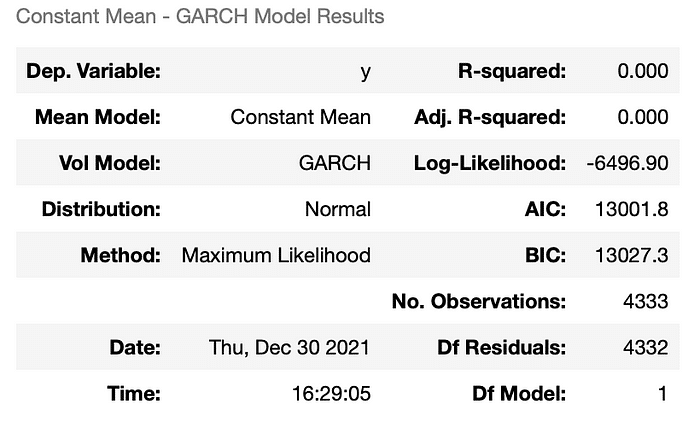

GARCH(1,1) model with Student-t distribution using AIC and BIC criteria | Download Scientific Diagram

![PDF] Skewed non-Gaussian GARCH models for cryptocurrencies volatility modelling | Semantic Scholar PDF] Skewed non-Gaussian GARCH models for cryptocurrencies volatility modelling | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/28ee139d6ac25244a98f79cd25342915fd3e7039/17-Table7-1.png)